First Time Buyer

Help To Buy – Equity Loan

How does it work?

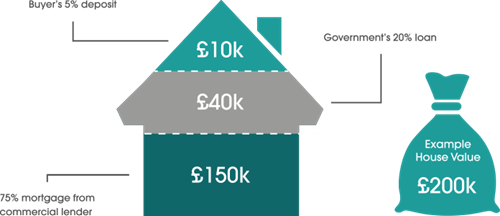

With a Help to Buy: equity loan the Government lends you up to 20% of the cost of your new-build home, so you’ll only need a 5% cash deposit and a 75% mortgage to make up the rest. You won’t be charged loan fees on the 20% loan for the first five years of owning your home. Example: for a home with a £200,000 price tag

If the home in the example above sold for £210,000, you’d get £168,000 (80%, from your mortgage and the cash deposit) and you’d pay back £42,000 on the loan (20%). You’d need to pay off your mortgage with your share of the money.

Who is Eligible?

Equity loans are available to first time buyers as well as homeowners looking to move. The home you want to buy must be newly built with a price tag of up to £600,000.

You won’t be able to sublet this home or enter a part exchange deal on your old home. You must not own any other property at the time you buy your new home with a Help to Buy equity loan.

This scheme is available in England only.

A mortgage is a loan secured against your home. Your home may be repossessed if you do not keep up repayments on your mortgage or any other debt secured on it.

23 Austin Friars, London, EC2N 2QP

23 Austin Friars, London, EC2N 2QP

+44 203 750 0001

+44 203 750 0001

info@austinfriars.city

info@austinfriars.city